One of the main reasons we don’t see as many scholarships as we would like to is because scholarships are not so easy to set up and launch. Nowadays, the pandemic has impacted all of our lives and students are no different. The need for scholarships is greater than ever before and students are applying more vigorously than ever before in these challenging times.

Ever since we created ScholarshipApp, it was our aim to make it easier to launch a scholarship and help more students. Today, we’re one step closer.

Introducing: the Fund Manager

We’ve talked about the fund manager feature before, which allows you to use an AAA-rated payment processor when you launch a scholarship. This means that you don’t have to worry about paying out the student once you choose your winner and the students know that they will get their award.

But what if you want to make sure that the money you award is also tax-deductible? We got you covered. Our latest addition to ScholarshipApp is called the Fund Manager and it helps you do just that – make your scholarship 100% tax-deductible.

How does it work?

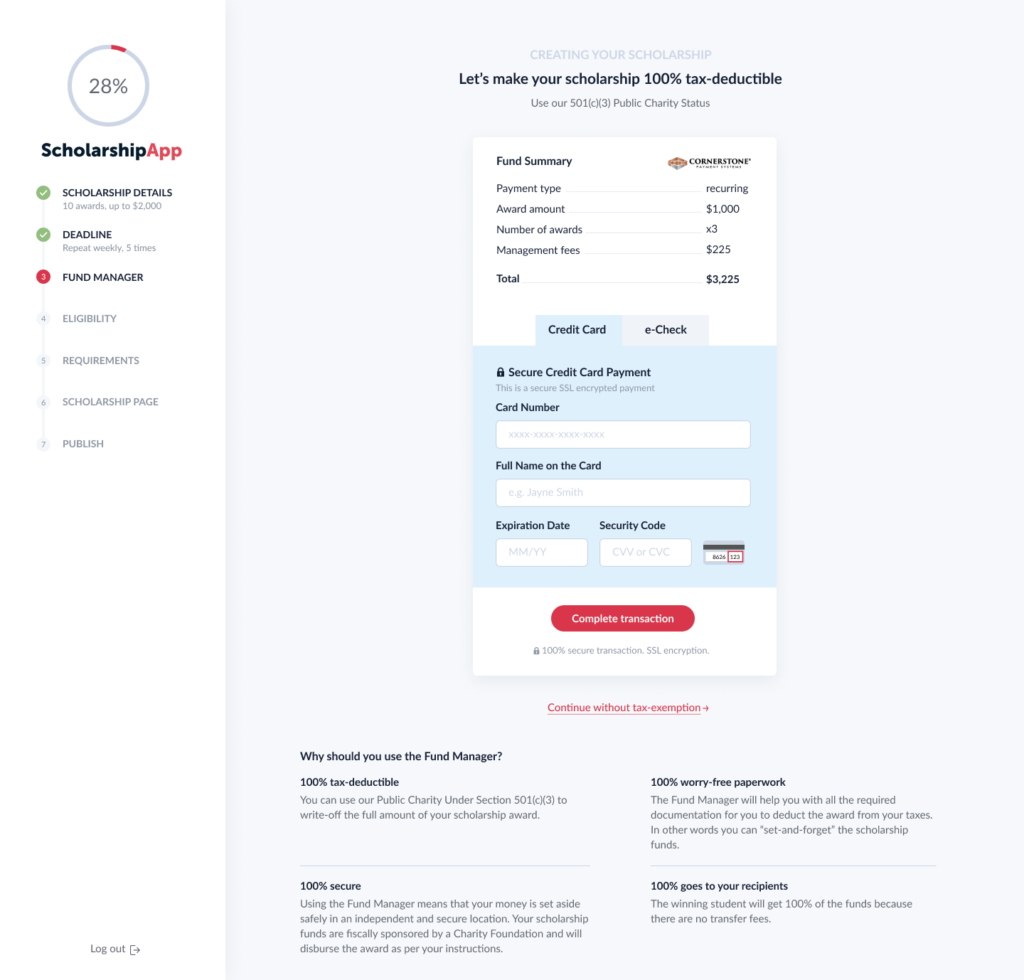

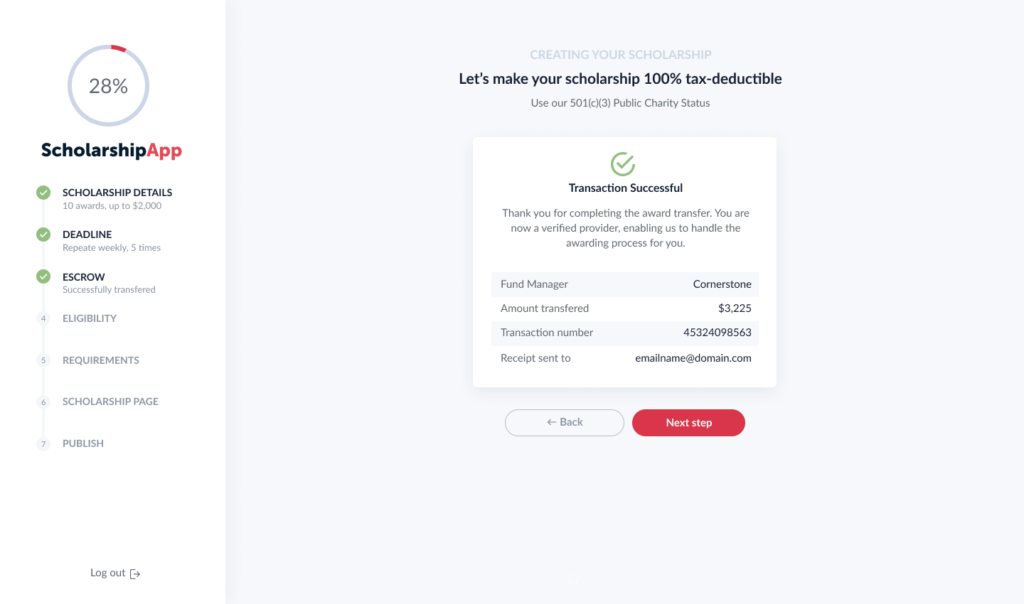

When you’re setting up your scholarship, you have the option of making it 100% tax-deductible through our Fund Manager. Simply choose your payment type, the number of awards and how much the amount is. Just choose the type of payment (credit card or e-check) and you’re good to go.

Once you’ve done all this, your award will be handled by a 501(c)(3) organization that powers our Fund Manager. Moreover, you will then be able to use our 501(c)(3) Public Charity Status and have your scholarship 100% tax-deductible.

At the moment of writing, this feature is only available for companies from the United States that want to launch a scholarship with us.

How do I get started?

Simply sign up for ScholarshipApp for free and we’ll get you up and running within 20 minutes. Launching your own scholarship has never been easier!